April 1st,

2015, Superior, Wisconsin USA

When Terry Scott helps prospective insurance clients in and

around Superior Wisconsin to navigate through Obama’s Healthcare or decide what

“corporate style benefits” type of insurance package they should have, he’s not

what most might think of as the typical “friendly” insurance agent.

Having been voted “the friendliest” in his graduating class, Scott

contends that when it comes to selling insurance people need a consultant more

than they need a friend. “I don’t chase people” states Scott, “they either want

to protect themselves, their loved ones and their legacy, or they don’t”. After

being in the Life & Health industry off and on for 10 years he admits this

may contrary to the usual way of doing business by most agents and the tenets from

the book “How to Win Friends and Influence People” but he insists that he still

remains cordial and professional.

“I work on being the best resource that I can be to my

clients, prospective clients and fellow agents from all around the country who

seek my advice. There is only so much time in the day and it can’t be spent on “tire

kickers” when there are so many others who are serious about wanting that

advice and taking action to protect themselves. When people are serious about

what’s important, that’s when I can be their best coach”.

Scott is licensed in Minnesota and Wisconsin but answers

questions to consumers and agents nationwide via his blog and website. Having

been an instructor for many years he likes to give people “assignments” to move

forward with their insurance needs in a step by step fashion. “When I give

someone an assignment; some step in the process to complete before we can move

forward, and if they don’t do it; I may not always follow up. I’m not their

babysitter and it’s their loss”.

Scott is licensed in Minnesota and Wisconsin but answers

questions to consumers and agents nationwide via his blog and website. Having

been an instructor for many years he likes to give people “assignments” to move

forward with their insurance needs in a step by step fashion. “When I give

someone an assignment; some step in the process to complete before we can move

forward, and if they don’t do it; I may not always follow up. I’m not their

babysitter and it’s their loss”.

Scott is not alone as an agent pressed for time. An aging population and changes in federal

regulations have increased demand for agents who sell health and long-term care

insurance. Further, according to LIMRA, a worldwide association that

provides research, consulting, and other services to insurance companies

states that thirty

percent of U.S. households have no life insurance at all; and fifty percent of

U.S. households (58 million) say they need more life insurance.

With time being a factor, much of Scott’s business is

completed with the client and him at their computers sharing screens. “Most of

the forms are online these days so this speeds the application process and cuts

down on drive time to see clients at their home or business”, says Scott.

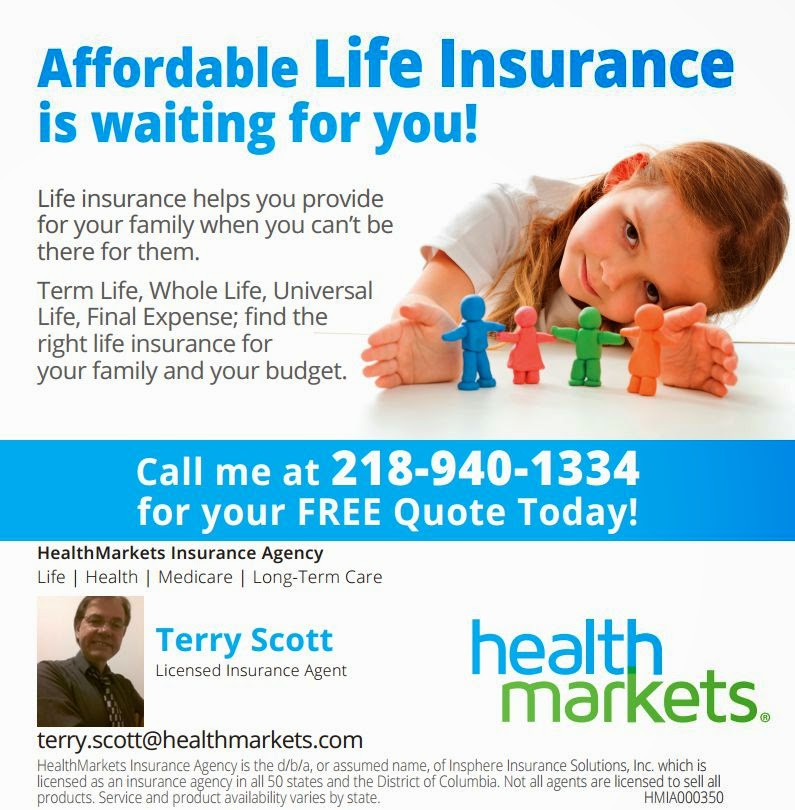

Terry Scott in an insurance agent in Superior Wisconsin offering Life

& Health products: Health, Medicare, Life, Dental, Vision, Disability,

Accident, Critical Illness, Cancer, Annuity, Long Term Care, and Wellness

Programs and related.

Contact:

Terry Scott,

888-241-4031

People who read this were also interested in: